Case Study – Charity

HostedPCI was approached by a merchant who collaborates with various charities to facilitate their payments through multiple payment processors. This merchant needed a secure method to collect and store credit card data from different charities. The charities, in turn, gather credit card information from donors and store it locally until the merchant can process it.

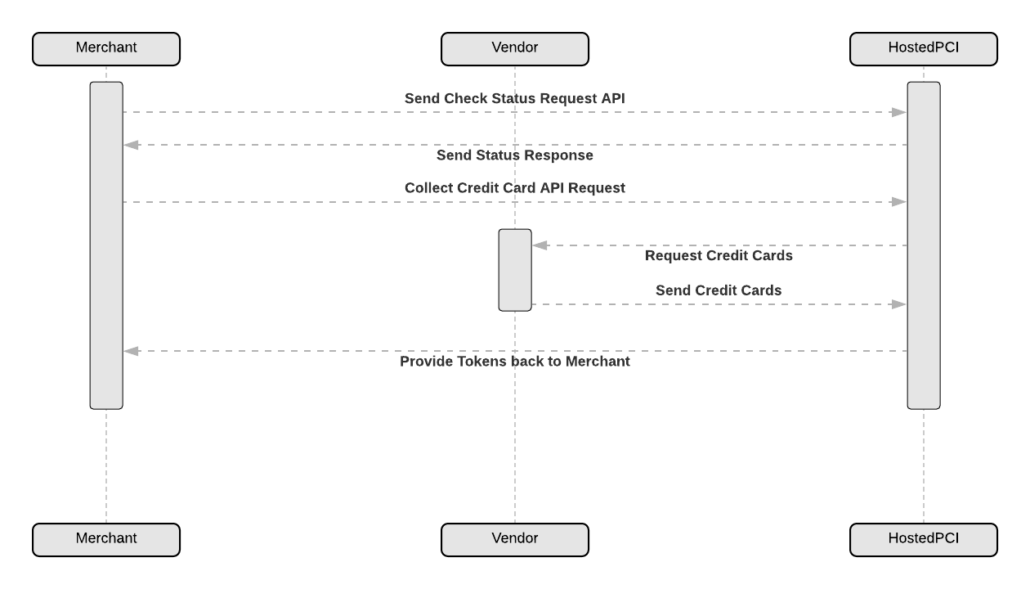

To address this, HostedPCI introduced a new feature called ‘Inbound Message Transfer’. This feature was designed for merchants needing to retrieve credit card data from an SFTP location without compromising their PCI scope. It ensures PCI compliance by preventing the merchant from accessing the actual credit card data, with HostedPCI managing the transfer between individual vendors and the merchant.

The merchant aimed to reduce their PCI scope by avoiding direct contact with actual credit cards and eliminating the need for in-house storage. A significant challenge was the unique collection processes of each charity, which were not easily adaptable to a new platform. Most tokenization solutions necessitate direct merchant contact with the credit card, making it challenging to find a solution where the merchant does not control the collection process.

HostedPCI provided an ideal solution, requiring no changes to the vendors’ infrastructure and preventing credit card data from entering the merchant’s environment. The Inbound Message Transfer feature collects credit card information files from vendors, tokenizes the credit cards with a new HostedPCI token, and returns the newly generated tokens to the merchants for future transaction processing.

After resolving the collection issue, HostedPCI addressed the merchant’s need for multiple payment processing methods. The merchant, working with various vendors for payment processing, needed to send real-time payments through specific gateways and upload batch files to additional third-party payment processors in unique situations. HostedPCI supported multiple gateways at no additional cost, requiring the merchant to manage only one token. For batch file processing, HostedPCI enabled the merchant to upload real credit card files to specified SFTP locations for third parties to access the information.

In conclusion, HostedPCI’s flexible and customizable inbound and outbound credit card processing solution effectively removed all credit cards from the client’s environment, reducing their PCI scope. HostedPCI offers merchants customizable payment processing solutions to meet diverse business needs and minimize PCI scope. Please contact us today for more information and a free demo on various credit card collection and processing solutions.