Zero-Trust Payment Architecture: How to Secure Checkout, APIs, and Tokenization in 2026

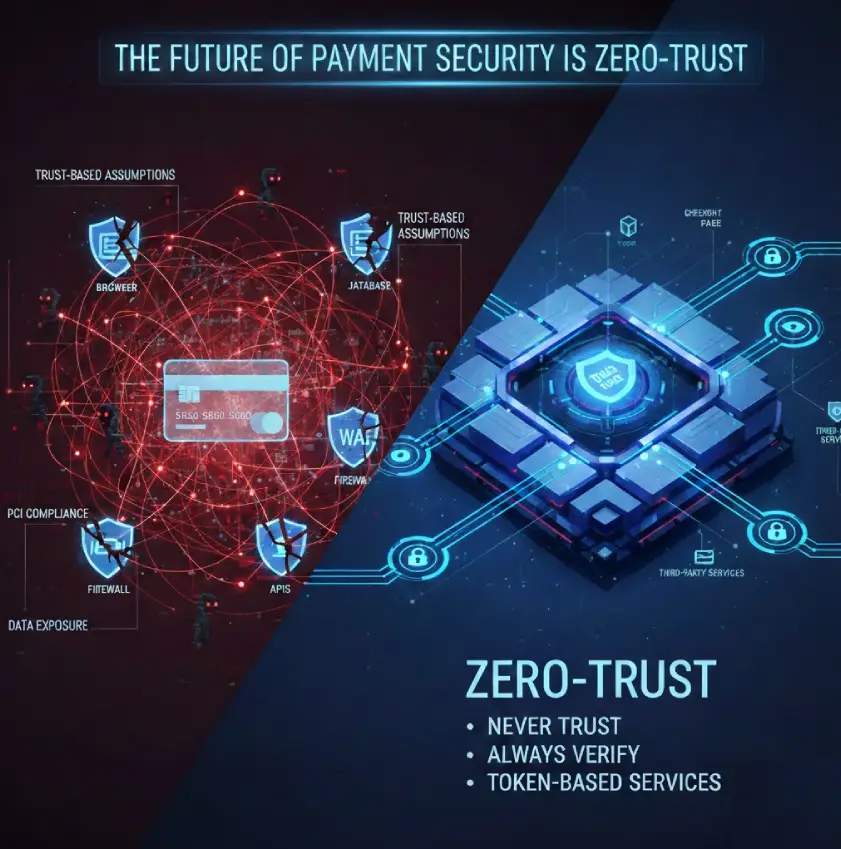

In 2026, most payment breaches don’t happen because companies lack firewalls, encryption, or PCI compliance. They happen because payment systems are still built on trust-based assumptions that no longer match how modern attacks work.

Attackers don’t break into servers. They slip into JavaScript, APIs, plugins, call-center tools, and third-party integrations, quietly intercepting payment data long before it ever reaches a gateway.

This is why the future of payment security is Zero-Trust architecture.

Zero-Trust payments are not a product or a checkbox. They are a design philosophy: No system, script, or user should ever be trusted with raw payment data.

What Is Zero-Trust in Payment Security?

Zero-Trust means:.

Never trust. Always verify. Never expose sensitive data unless absolutely required.

In payments, this means:

- Checkout pages should never touch card numbers

- APIs should never receive PAN data

- Databases should never store sensitive payment details

- Third parties should never be allowed to see raw payment data

Instead, every interaction is mediated by secure, token-based services that strictly control what is exposed, when, and to whom.

This is the opposite of traditional payment stacks, where:

- Browsers collect card data

- JavaScript handles encryption

- Merchants pass PANs to gateways

- Databases store tokens and logs

- Plugins and vendors share access

Those models assume trust, and attackers exploit it.

Why Traditional Payment Security Fails in 2026

Most merchants still rely on:

- PCI compliance

- CSP headers

- JavaScript monitoring

- WAFs and firewalls

- Vulnerability scanning

These controls detect problems. They do not prevent data exposure.

If a malicious script runs in a browser, it can read whatever the browser sees, even if the merchant is PCI compliant.

If a compromised API key exists, attackers can call payment endpoints.

If a third-party plugin is breached, it can intercept checkout traffic.

Zero-Trust fixes this by removing the thing attackers want most: access to raw card data.

The Three Pillars of Zero-Trust Payments

1️⃣Zero-Trust Checkout

A Zero-Trust checkout means:

- Card numbers never pass through the merchant’s website

- No JavaScript on the merchant page can access sensitive fields

- No PCI scope exists for the checkout experience

This is achieved using secure hosted fields, iFrames, or direct vault capture, where sensitive data is collected inside a protected environment that attackers cannot touch.

Even if malware runs on the page, it only sees blank fields.

2️⃣Zero-Trust APIs

Modern payment stacks are API-driven, and APIs are now the #1 attack surface.

Zero-Trust APIs mean:

- No API ever accepts raw card data

- All requests use tokens instead of PANs

- Every call is authenticated, authorized, and logged.

Tokens become the only thing that moves through your infrastructure. If a token is stolen, it is useless outside of its approved payment context.

3️⃣Zero-Trust Tokenization

Tokenization is not just masking; it is data isolation.

In a Zero-Trust system:

- Tokens are controlled by the merchant, not the gateway

- Tokens can route across multiple processors

- Tokens do not leak data if intercepted

- Tokens can be revoked, rotated, or restricted

This turns payment data into a secure, governed asset instead of a liability.

What Zero-Trust Eliminates

A true Zero-Trust payment architecture prevents:

| Threat | Why it fails |

|---|---|

| E-skimming | No card exists in the browser |

| Magecart | Scripts cannot access secure fields |

| API breaches | No PAN data in the APIs |

| Plugin leaks | Tokens are useless to attackers |

| Database theft | No sensitive data at rest |

| Insider abuse | Least-privilege token access |

| Third-party risk | No shared data exposure |

How HostedPCI Enables Zero-Trust Payments

HostedPCI was designed around Zero-Trust long before the term became popular.

Our platform enforces Zero-Trust across:

Secure Data Capture

- iFrame & hosted field checkout

- IVR OmniFlow for call centers

- SMS & payment links

No merchant systems ever touch card data.

Gateway Tokenization

- Tokens are generated and issued by the payment gateway/processor

- HostedPCI securely captures and stores gateway tokens (not PANs) whenever possible

- Tokens are typically limited to the issuing gateway, reducing exposure if intercepted

- If you route to a different gateway, a new token is created for that gateway (without exposing PAN to your systems)

- All PCI scope is isolated inside HostedPCI’s secure vault

Your systems stay clean permanently.

Transparent Data Flow

Payment data flows directly from the customer into HostedPCI’s secure vault and then to processors without stopping in merchant systems, scripts, or logs.

This creates:

- Smaller PCI scope

- Fewer audit requirements

- Lower breach exposure

- Higher compliance confidence

Why Zero-Trust Is Now a Business Requirement

In 2026, payment breaches don’t just cost fines; they destroy customer trust, trigger mandatory disclosures, and put businesses on regulatory watchlists.

Zero-Trust payment architecture is no longer optional for:

- Subscription platforms

- Marketplaces

- Call centers

- SaaS platforms

- Healthcare, education, and utilities

- PSPs and payment facilitators

If your business touches payments, Zero-Trust is the only model that scales safely.

PCI compliance checks boxes. Monitoring detects problems. Zero-Trust prevents them.

The future of payment security isn’t better alerts, but it’s architectures that make breaches impossible.

HostedPCI exists to deliver that architecture.