Why Redundancy in Payment Data Vaulting is Critical for Enterprises

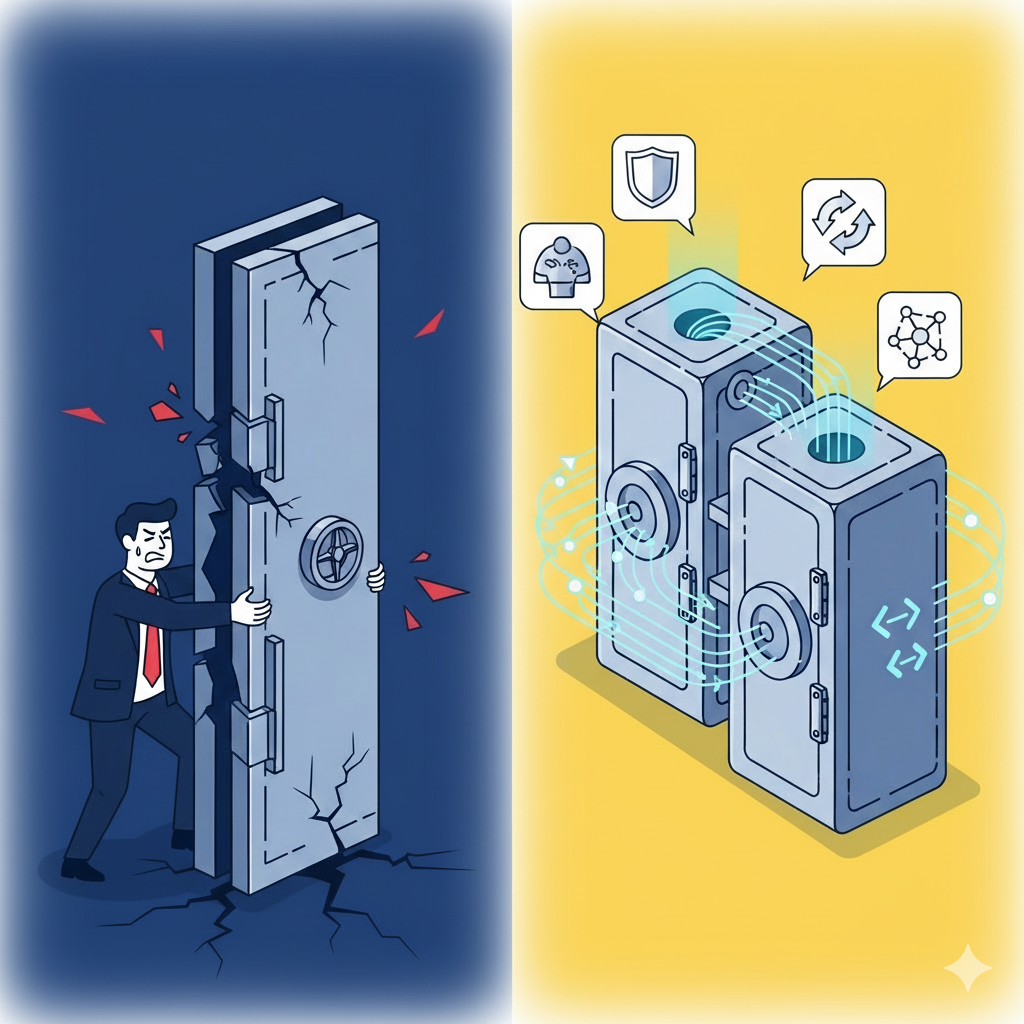

For enterprises handling millions of transactions, sensitive payment data is the lifeblood of operations. Yet too often, businesses store this data with a single provider. While convenient in the short term, this creates serious risks. If the provider experiences downtime, data corruption, or a compliance issue, the enterprise is left vulnerable. Even worse, if the provider’s costs or terms become unfavorable, switching vendors becomes a long and risky process.

This is where redundancy in payment vaulting becomes essential.

Redundancy in Payment Vaulting

Redundancy is more than just “backup.” It is about embedding resilience into payment infrastructure. By maintaining a cloned vault with HostedPCI alongside your existing provider, enterprises gain:

- Business continuity: Operations can continue even if one provider experiences downtime.

- Vendor flexibility: Avoid lock-in by keeping your payment data portable.

- Risk mitigation: Reduce exposure to data corruption, outages, or compliance failures.

- Strategic leverage: Gain negotiating power with the freedom to switch providers at any time.

For enterprises, this flexibility can translate into millions saved by avoiding downtime and lost transactions.

Building a Secondary Vault

Enterprises that manage sensitive payment data often choose to maintain a secondary PCI-compliant vault as part of their resilience strategy. Rather than relying on a single provider, businesses replicate or clone their data into another secure environment to safeguard against outages, disruptions, or compliance gaps.

Key advantages include:

- Tokens and payment records remain accessible in an independent environment.

- PCI DSS compliance is preserved across both vaults.

- Enterprises retain complete control and portability of their data.

- Switching or scaling providers becomes a streamlined process instead of a costly migration.

By making redundancy part of their core strategy, enterprises strengthen continuity while keeping future options open.

Avoiding Vendor Lock-In with a Multi-Vault Strategy

Vendor lock-in is one of the hidden costs of enterprise payments. When sensitive data is locked into a single provider’s vault, the enterprise loses control over customer relationships. HostedPCI’s redundancy model ensures that data portability stays in your hands, not your vendor’s.

This aligns with enterprise priorities such as::

- Compliance with PCI DSS 4.0.

- Business continuity planning (BCP).

- Disaster recovery and failover readiness.

- Future-proofing against technology or regulatory changes.

Secure Every Transaction with HostedPCI

Enterprises that rely on a single vault take on unnecessary risk. HostedPCI provides the redundancy and flexibility you need to keep payment data secure, compliant, and portable.