How Enterprises Can Maintain Control Over Their Payments While Staying PCI Compliant

Why Enterprises Are Rethinking Payment Control

For enterprise organizations, payments are more than just transactions; they’re a strategic advantage. Owning your payment data and managing how it flows across gateways gives you leverage, flexibility, and insight. But with that control comes one major obstacle: PCI DSS compliance.

Handling or storing cardholder data brings your systems into PCI scope, introducing audits, certification costs, and operational complexity.

Today, many enterprises are asking a key question:

“How can we maintain full control of our payment ecosystem while staying PCI compliant?”

The PCI Challenge: Security vs. Innovation

For large organizations, PCI compliance often becomes a bottleneck that slows innovation.

- Every new integration triggers revalidation.

- Storing raw card data increases risk and audit scope.

- Compliance costs scale as systems and teams grow.

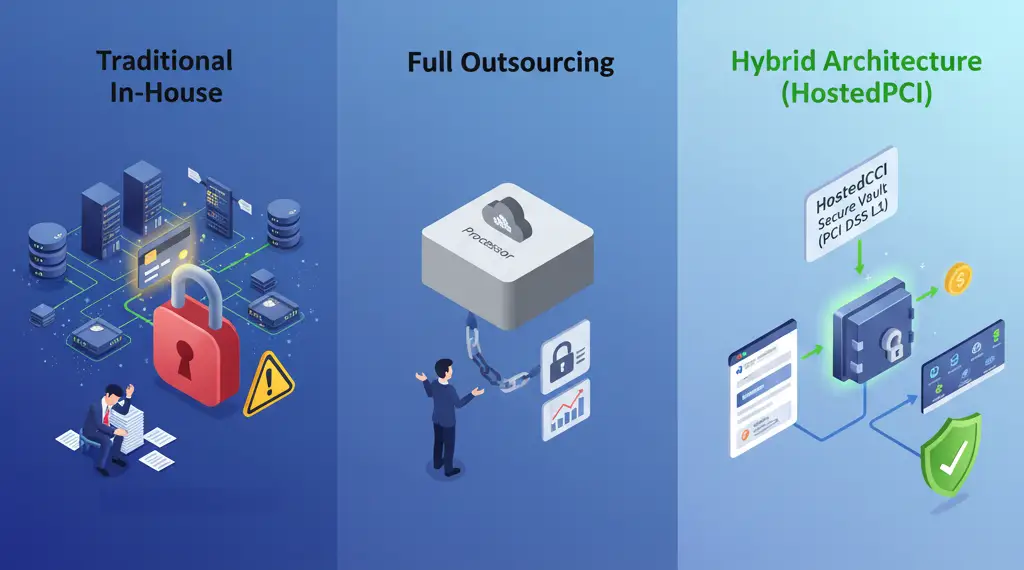

While outsourcing to a payment processor can reduce PCI scope, it also removes control:

- You lose access to valuable customer data.

- You depend on third parties for uptime, reporting, and flexibility.

- Adding new gateways or routing rules requires external approval.

Neither full outsourcing nor full in-house control provides the balance enterprises need.

The Solution: Hybrid Payment Architecture

The most effective way for enterprises to maintain control while ensuring compliance is through a hybrid payment model, one that separates data handling from payment orchestration.

With HostedPCI, merchants can collect payment information securely through HostedPCI’s iframe or API. The sensitive card data never enters the merchant’s systems.

Instead, HostedPCI, a PCI DSS Level 1 compliant provider, securely stores, manages, and processes cardholder data on the merchant’s behalf. Each card is tokenized, and the merchant receives a HostedPCI token that can safely be used for future transactions, routing, analytics, or gateway optimization.

This design ensures that:

- The merchant’s environment remains outside PCI scope

- HostedPCI securely handles and stores cardholder data

- Enterprises retain full control of their payment logicwithout assuming PCI liability

This hybrid approach delivers the best of both worlds, complete payment control with full PCI compliance.

Why Enterprises Choose HostedPCI

HostedPCI helps global enterprises achieve payment freedom with compliance certainty.

Our platform offers:

- PCI Level 1 Vaulting and Tokenization We securely handle and store sensitive data, ensuring your systems remain out of PCI scope.

- Data Ownership and Flexibility You retain control of your customer data, routing rules, and analytics while avoiding vendor lock-in.

- Multi-Gateway Optimization Connect to multiple processors, add redundancy, and route transactions for better performance and cost efficiency.

- Omnichannel Capability Accept payments through web, IVR, SMS, and more, all under a unified PCI-compliant framework.

- Future-Ready Compliance HostedPCI meets and exceeds PCI DSS 4.0 standards to keep your organization ahead of evolving requirements.

Business Impact: Compliance Without Compromise

By decoupling PCI compliance from payment orchestration, enterprises can achieve measurable improvements:

- Up to 70% reduction in PCI audit scope and compliance costs

- Faster rollout of new payment channels and features

- Higher authorization rates through dynamic routing.

- Improved uptime and redundancy with multiple gateways.

- Full visibility and control across every transaction.

It’s not just about compliance, it’s about agility, security, and long-term growth.

Case Example: Enterprise Payment Control in Action

Many subscription-based clients rely on HostedPCI to maintain control over their payment flows while managing complex operational requirements such as transaction retries, dynamic routing, and jurisdictional compliance.

Enterprise organizations often need to:

- Orchestrate transactions based on customer location

- Route payments through specific gateways to meet regional regulations

- Comply with data residency and jurisdictional storage rules

- Reduce transaction costs by leveraging multiple processors

HostedPCI enables these capabilities through a customizable and flexible PCI-compliant architecture.

Our team works closely with enterprise clients to:

- Configure custom parameter calls that match their business logic

- Store and process data according to jurisdictional compliance needs

- Integrate with multiple gateways, allowing clients to create dedicated profiles for each region or business unit

This approach gives enterprises complete control over their payments, optimizing performance, maintaining compliance, and reducing overall transaction costs, all while staying outside PCI scope.

How HostedPCI Helps You Lead With Control

HostedPCI empowers enterprises to:

- Collect and tokenize cardholder data securely

- Route transactions intelligently across gateways

- Maintain PCI compliance without infrastructure overhead

- Innovate faster while reducing compliance risk

Your flow. Your data. Your control. HostedPCI makes it PCI compliant.