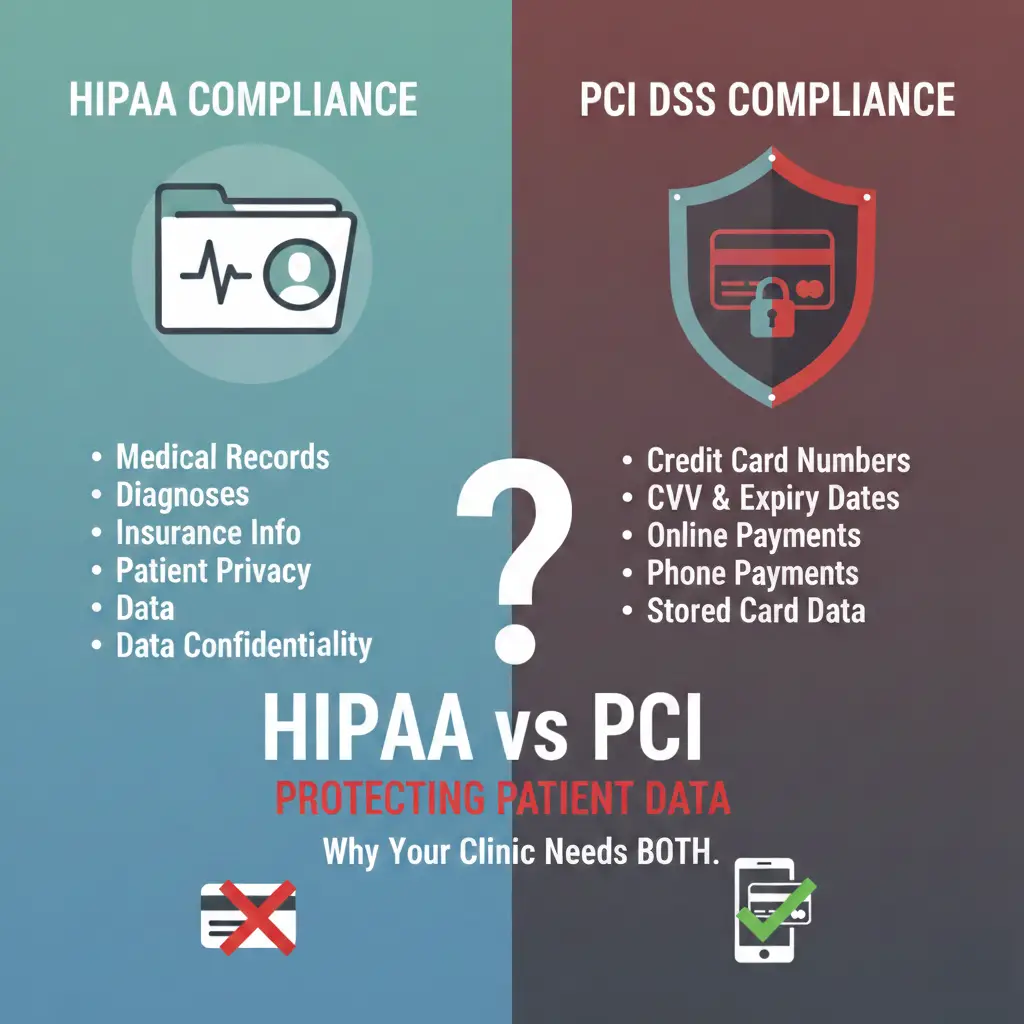

HIPAA vs PCI: Why Medical Clinics Need Both to Truly Protect Patient Data

Most medical clinics believe that being HIPAA compliant means their patient data is secure.

But here’s the uncomfortable truth: HIPAA does not protect payment data.

If your clinic accepts credit or debit cards, online, over the phone, or in person, you are also subject to PCI DSS, a completely separate compliance standard with different rules, risks, and penalties. And most clinics are unknowingly failing it.

What HIPAA Actually Covers

HIPAA is designed to protect Protected Health Information (PHI), such as:

- Medical records

- Diagnoses and treatment details

- Insurance information

- Patient identifiers

- Appointment data

HIPAA focuses on:

- Patient privacy

- Access controls

- Data confidentiality

- Secure handling of health records

HIPAA does not regulate:

- Credit card numbers

- Payment gateways

- Billing portals

- Call center payment recordings

- Stored card data

Which is exactly where most breaches now occur.

What PCI Compliance Covers (and Why It’s Separate)

PCI DSS applies to any organization that stores, processes, or transmits cardholder data, including medical clinics.

PCI covers:

- Card numbers (PAN)

- CVV and expiry dates

- Online payment forms

- Phone payments

- Recurring billing

- Stored cards on file

If your clinic:

-

- accepts payment by card

- bills patients monthly with stored payment information

- processes payments by phone

- uses online patient portals

You are legally required to follow PCI rules regardless of HIPAA.

The Biggest Risk Areas for Clinics

Most clinics think their risk is in their EMR or patient database.

In reality, the highest-risk systems are:

- Patient portals

- Front desk terminals

- Call center payments

- Telehealth billing

- Third-party billing services

- Stored cards for recurring

These systems often sit outside HIPAA audits but inside PCI scope.

That creates a massive blind spot.

Why HIPAA Alone Is Not Enough

HIPAA audits usually focus on:

- staff access

- medical records

- internal systems

They rarely test:

- payment pages

- JavaScript security

- API endpoints

- call recordings

- gateway integrations

So a clinic can be fully HIPAA compliant and still suffer a payment breach.

And regulators will still hold the clinic responsible.

How Securing Both Actually Protects Your Clinic

When clinics secure both HIPAA and PCI, they gain:

Lower breach risk

- Payment data never touches internal systems.

Reduced compliance scope

- Fewer systems need audits and controls.

Stronger cyber insurance posture

- Insurers now ask about payment security separately.

Less third-party exposure

- Vendors never see raw card data.

Higher patient trust

- Patients feel safer sharing information and paying digitally.

The Modern Way to Achieve Both Without Complexity

Clinics don’t need more software or internal IT teams. They need payment architectures that isolate sensitive data entirely.

That means:

- No card data in EMRs

- No card data in patient portals

- No card data in call centers

- No card data is stored on the clinic servers

Only secure tokens move through systems.

How HostedPCI Supports HIPAA and PCI Together

HostedPCI helps clinics achieve both standards by:

Secure Data Capture

- Hosted checkout fields

- IVR OmniFlow for phone payments

- Secure payment links for patients

- Mobile and portal integrations

Card data is captured in a PCI-certified environment, not inside clinic systems.

HIPAA protects health data. PCI protects payment data. Your clinic is responsible for both.

Most healthcare breaches today don’t happen in medical records; they happen in billing systems. The safest clinics in 2026 won’t just be HIPAA compliant. They’ll be architecturally incapable of leaking payment data.

That’s the future of healthcare security.